Every time your trading strategy buys or shorts a security, it incurs a cost. This cost could be a brokerage fee, driving the bid-ask spread, or even delays in the time your program takes to send an order to your brokerage and the time the order is executed.

A brokerage fee is exactly what it sounds like. Each trade costs a certain amount of money to go through. This fee used to be larger in the past, but many brokerages today are able to eliminate it. Individuals who are trading in overseas markets still have to pay the cost and should keep these fees in mind. While many brokerages today eliminate it, it is always important to use a reliable broker!

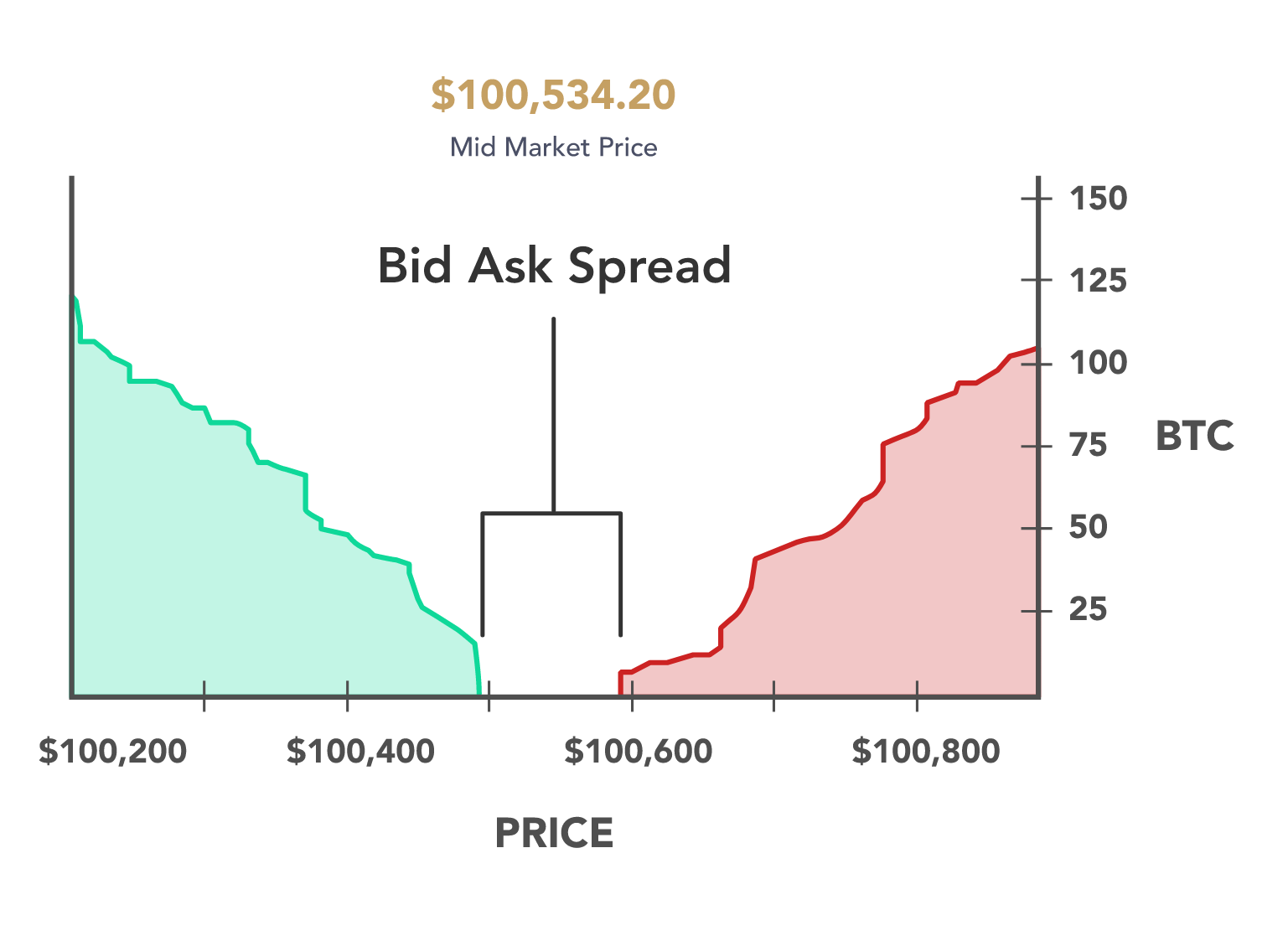

Driving the bid-ask spread creates costs, especially in large trades. One thing stock market beginners don’t know is the price you see for a security is the average of the lowest a seller is willing to sell their share and the highest a buyer is willing to buy a share. When we initiate a large transaction, we increase the number of bids for a particular security, thus driving the price. This is the reason professional investors, such as Mohnish Pabrai or Warren Buffet, take weeks to months to finalize a position! Of course, this can be eliminated using a limit order, but as a trader you are possibly losing out on the opportunity to buy the security.

The final transaction cost involves a delay between the time your program sends an order to your brokerage, and the time it is executed. This could be due to bad internet or other software problems. The difference between the price that triggers the order and the price at which the order is executed is called a slippage, and on average is usually a negative cost.

Don’t forget to keep transactional costs in mind when determining your ratios or final P/Ls!

That’s all we have! Now that you understand it, let's put these learnings into practice. If you’re excited about this space and quantitative finance, we love to hear more about why you’re interested and encourage you to get started by building your own trading model using Blankly. Want to learn even more? Join our Discord and our newsletter.